The Truth About 3-Month Loans: Payday, Personal & Installment

In the lending business, payday, personal, and installment loans offer a compelling blend of flexibility and manageable terms. These loans, though different in their structure and purpose, provide a timely financial boost to individuals in varying circumstances, from those facing sudden emergencies to those making significant purchases or looking to consolidate debt. Understanding their unique features, benefits, and considerations is crucial to making informed borrowing decisions.

Clearing Misconceptions About 3-month Loans

When it comes to borrowing money, understanding your options is paramount. The world of lending is often misunderstood, particularly when it comes to the term “3 month loans”. Let’s explore this world and clear the fog of confusion.

The Confusion Between Payday, Personal, and Installment Loans

Often, payday loans, personal loans, and installment loans are wrongly interchanged. Each one serves a unique purpose and understanding these differences can make a significant impact on your financial decisions.

Understanding Payday Loans

Payday loans, often referred to as cash advance loans, are designed to cover short term cash shortages. These loans are typically small. Often not exceeding $1000, and the repayment is expected by your next payday.

Typical Amounts and Duration of Payday Loans

A payday loan is typically a small amount ranging from $100 to $1,000. The duration is short, usually until your next paycheck, hence the name. This could be as short as a week or as long as 1 month (from 7 day to 30 days).

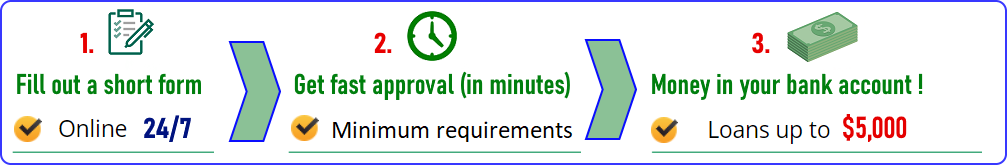

The Application Process for Payday Loans

Applying for a payday loan is a relatively straightforward process. You’ll need proof of income, a bank account, and valid identification. However, these loans often come with high interest rates and fees, making them a costly form of credit.

The Role of Payday Loans in Financial Emergencies

Despite their high costs, payday loans can serve a purpose. They can help handle sudden emergencies where you need cash quickly and can guarantee repayment with your next paycheck.

Dissecting the Difference between Payday Loans and Installment Loans

Unlike payday loans, installment loans allow you to borrow a more significant amount and pay it back over time. The payments or “installments” are spread out over several months or even years.

Typical Amounts and Duration of Installment Loans

The amounts of installment loans can vary widely but can go up to $5000. The loan duration could range anywhere between a few months to a few years, depending on the specific terms of your loan and your ability to make payments.

The Application Process for Installment Loans

The process of obtaining an installment loan isn’t much different from a payday loan. Lenders will ask for proof of income, a bank account, and valid identification. However, the screening process might be stricter due to the larger loan amounts.

Comparing Installment Loans with Payday Loans

While payday loans are suitable for immediate, short-term needs, installment loans are better for larger expenses that you’d like to pay over a longer period. The longer loan term makes the loan repayment more manageable.

The Versatility of Personal Loans

Personal loans are a type of installment loan that can be used for a variety of purposes. These loans are usually larger and have longer terms than payday or installment loans.

Typical Amounts and Duration of Personal Loans

Personal loans can range anywhere from $1,000 to $50,000 or more, and the repayment term can span several years. The specific amount and term depend on your creditworthiness and the lender’s policies.

The Application Process for Personal Loans

Applying for a personal loan involves a more in depth credit check compared to payday or installment loans. Lenders assess your credit score, employment status, and other financial factors. Although it can be a more lengthy process, it could be worthwhile if you secure a loan with lower interest rates.

Comparing Personal Loans with Payday and Installment Loans

Personal loans tend to have lower interest rates and longer repayment periods than payday and installment loans. They are beneficial when you need a larger amount that you can pay back over time.

Examining the Pros and Cons of 3-Month Loans

The Benefits of 3-Month Loans

The Benefits of 3-Month Loans

3-month loans offer quick cash when you’re in a financial pinch. Whether it’s a medical emergency, unexpected repair bills, or other unplanned expenses, these loans can provide a short-term solution.

The Drawbacks of 3-Month Loans

The Drawbacks of 3-Month Loans

However, 3-month loans also have drawbacks. The short repayment period and high-interest rates can make it a costly form of borrowing, leading to a cycle of debt for those who struggle to repay the loan in time.

Real Life Situations Where 3 Month Loans Are Beneficial

In real life scenarios, 3-month loans can be beneficial to manage unexpected expenses or financial emergencies. For instance, if your car breaks down and you need immediate funds for repair, a 3-month loan could help tide over the crisis.

Real-life Situations Where 3-Month Loans Can Lead to Financial Struggles

Conversely, if your income isn’t stable or if you’re already dealing with substantial debt, taking a 3-month loan could push you deeper into financial struggles. The high costs and short repayment period might lead to a cycle of taking new loans to pay off old ones.

Debunking Common Misconceptions about 3-month Payday Loans

The term “3-month payday loan” is not accurate. A payday loan is typically due by your next payday, which is usually a month or less from when you take the loan. If you hear the term “3 month payday loans,” be cautious and make sure you understand the terms before borrowing.

Understanding the Terms and Amounts of Payday, Installment, and Personal Loans

While payday, installment, and personal loans can provide the funds you need, their terms and amounts can differ greatly. Understanding these differences can help you choose the right loan for your situation.

Dispelling Confusions about Loan Repayments and Interest Rates

It’s essential to understand that while the idea of repaying a loan over three months may seem appealing, it might come with higher interest rates. Always read and understand the loan terms and calculate the total cost of the loan before deciding.

The Right Way to Choose a Loan

When choosing a loan, consider factors like how much you need, how quickly you can repay the loan, the fees, and interest rates, and your credit score. These factors will guide you to the loan that best fits your needs. Sometimes if a loan is not urgent, holding off for a few months while your credit score increases can save a lot of money.

The Role of Financial Health in Choosing a Loan

Your financial health plays a significant role in determining what kind of loan is suitable for you. A good credit score can get you better loan terms, while a lower score might restrict your options.

The Importance of Repayment Capability

Your ability to repay the loan is crucial. Much of the underwriting process is to ensure your capacity to repay the loan. You must ensure that you can make the repayments on time to avoid additional fees, higher interest, and potential damage to your credit score.

Understanding the Terms and Conditions of Different Loans

Understanding the terms and conditions of different loans is crucial before you sign any agreement. Ensure you know exactly what you’re agreeing to, including the interest rate, fees, and repayment terms.

Comparing Loans: A Step-by-Step Guide

Identifying Your Needs – First, understand why you need the loan and how much you need. This will guide you in selecting the right type of loan.

Identifying Your Needs – First, understand why you need the loan and how much you need. This will guide you in selecting the right type of loan.

Evaluating the Cost of Loans – Look at the interest rates, fees, and the overall cost of the loan over time. This comparison will help you understand the most economical option for your situation.

Evaluating the Cost of Loans – Look at the interest rates, fees, and the overall cost of the loan over time. This comparison will help you understand the most economical option for your situation.

Understanding Repayment Terms – Carefully examine the repayment terms of each loan option. Understand the monthly payments and the loan term, as they directly impact your financial planning.

Understanding Repayment Terms – Carefully examine the repayment terms of each loan option. Understand the monthly payments and the loan term, as they directly impact your financial planning.

Researching Lender Reputation – Reputation matters. Research the lenders thoroughly, look for reviews and ratings, and ensure they are licensed and regulated.

Researching Lender Reputation – Reputation matters. Research the lenders thoroughly, look for reviews and ratings, and ensure they are licensed and regulated.

Making an Informed Decision – After evaluating your needs, costs, repayment terms, and lender reputation make an informed decision. Always ensure the loan is affordable and fits into your financial plan.

Making an Informed Decision – After evaluating your needs, costs, repayment terms, and lender reputation make an informed decision. Always ensure the loan is affordable and fits into your financial plan.

Recap of the Key Points

To recap, payday loans are best for short-term financial needs, installment loans can help you spread out the repayment over a longer period, and personal loans offer more considerable sums for more significant needs.

Importance of Making Informed Decisions

The importance of making informed decisions can’t be overstressed. Always ensure that you fully understand the terms of any loan before proceeding.

The Role of Loans in Financial Planning

Loans play a critical role in financial planning. They can help bridge gaps but can also lead to financial troubles if not managed properly.

Remember, a loan is a tool. Like any tool, it can be helpful if used correctly and damaging if used improperly. Always consider your ability to repay before taking on a loan. By understanding the truth about 3-month loans, payday loans, personal loans, and installment loans, you’re better equipped to navigate the world of lending and make sound financial decisions.