From 1 Week to 1 Month Payday Loans ($100 – $1,000)

In today’s fast-paced world, financial emergencies can arise when you least expect them. Whether it’s a sudden medical bill, a car repair, or an unexpected home repair, these situations often demand quick access to funds.

This is where payday loans, specifically 7-30 days loans ranging from $100 to $1,000, can provide a valuable solution. In this article, we will explore the benefits of these short-term loans, their different durations, and how they can serve as a financial lifeline for many individuals.

What Are Payday Loans?

Payday loans are short-term loans designed to provide individuals with quick access to funds before their next paycheck arrives. These loans are hugely popular due to their ease of access and simplicity — just about anyone can apply for a payday loan.

They are typically smaller in amount and have a shorter repayment period compared to traditional loans, making them a practical choice for urgent financial needs.

7 Day Payday Loans: A Quick Financial Fix

When faced with an immediate financial crisis, waiting for an extended loan approval process can make the situation even worse. This is where 7 day payday loans come into play. These loans are designed to bridge the gap between your current situation and your next paycheck, ensuring that you can handle urgent expenses without having to wait.

Benefits of a 7 Day Payday Loan

Speedy Approval Process: One of the primary benefits of 7 day payday loans is the rapid approval process. Traditional loans often involve extensive paperwork and credit checks that can take days or even weeks. On the other hand, payday loans can often be approved within hours, providing you with the necessary funds almost immediately.

Speedy Approval Process: One of the primary benefits of 7 day payday loans is the rapid approval process. Traditional loans often involve extensive paperwork and credit checks that can take days or even weeks. On the other hand, payday loans can often be approved within hours, providing you with the necessary funds almost immediately. Minimal Eligibility Criteria: Payday lenders typically have minimal eligibility requirements, making it easier for individuals with varying credit scores to access funds. This inclusivity ensures that even those with less-than-perfect credit histories have an option when facing financial emergencies.

Minimal Eligibility Criteria: Payday lenders typically have minimal eligibility requirements, making it easier for individuals with varying credit scores to access funds. This inclusivity ensures that even those with less-than-perfect credit histories have an option when facing financial emergencies. No Collateral Needed: Unlike secured loans that require collateral, payday loans are unsecured. This means that borrowers do not have to put their assets on the line to secure the loan, making them a safer option for those who may not have valuable assets to offer as collateral.

No Collateral Needed: Unlike secured loans that require collateral, payday loans are unsecured. This means that borrowers do not have to put their assets on the line to secure the loan, making them a safer option for those who may not have valuable assets to offer as collateral.

30 Day Loans: An Extended Repayment Option

While 7 day loans are great for quickly fixing immediate financial burdens, 30 day payday loans provide a slightly longer repayment period. These loans cater to individuals who require a bit more time to reimburse the borrowed amount while still reaping the benefits of quick and convenient payday loans.

Benefits of a 30 Day Payday Loan

Repayment Flexibility: With a 30 day payday loan, borrowers enjoy much more flexibility in their repayment schedule. This can be incredibly helpful when dealing with larger, unexpected expenses that can’t be comfortably settled within a week.

Repayment Flexibility: With a 30 day payday loan, borrowers enjoy much more flexibility in their repayment schedule. This can be incredibly helpful when dealing with larger, unexpected expenses that can’t be comfortably settled within a week. Continued Expediency: Despite the extended repayment period, 30 day payday loans still offer a quick and convenient borrowing experience. The application and approval processes are still streamlined, enabling borrowers to swiftly obtain funds as needed.

Continued Expediency: Despite the extended repayment period, 30 day payday loans still offer a quick and convenient borrowing experience. The application and approval processes are still streamlined, enabling borrowers to swiftly obtain funds as needed. Cushion for Unforeseen Delays: Sometimes, even with the best intentions, unexpected delays can occur that hinder your ability to repay a loan within a week. A 30 day loan provides a buffer, allowing you to manage unforeseen circumstances without the immediate pressure of repayment.

Cushion for Unforeseen Delays: Sometimes, even with the best intentions, unexpected delays can occur that hinder your ability to repay a loan within a week. A 30 day loan provides a buffer, allowing you to manage unforeseen circumstances without the immediate pressure of repayment.

Addressing Larger Emergencies with $1,000 Payday Loans

For more substantial financial emergencies, a $1,000 payday loan can provide the necessary funds to tackle unexpected expenses that might otherwise cause significant stress. While these loans have a slightly higher borrowing limit, they still retain the benefits of speed and accessibility associated with payday loans.

Benefits of a $1,000 Payday Loan

Higher Loan Limit: The $1,000 loan limit offers borrowers access to a more substantial amount of funds, allowing them to address larger financial emergencies such as major car repairs or medical bills.

Higher Loan Limit: The $1,000 loan limit offers borrowers access to a more substantial amount of funds, allowing them to address larger financial emergencies such as major car repairs or medical bills. Quick Response: Despite the higher amount, $1,000 payday loans still come with the speed of approval and funding that makes payday loans attractive. This is essential when dealing with urgent expenses that cannot wait.

Quick Response: Despite the higher amount, $1,000 payday loans still come with the speed of approval and funding that makes payday loans attractive. This is essential when dealing with urgent expenses that cannot wait. Avoidance of Long-Term Debt: Traditional loans with large amounts and extended repayment terms can lead to long-term debt. $1,000 payday loans offer a way to address immediate needs without locking borrowers into long-lasting financial commitments.

Avoidance of Long-Term Debt: Traditional loans with large amounts and extended repayment terms can lead to long-term debt. $1,000 payday loans offer a way to address immediate needs without locking borrowers into long-lasting financial commitments.

How Do Online Payday Loans Work?

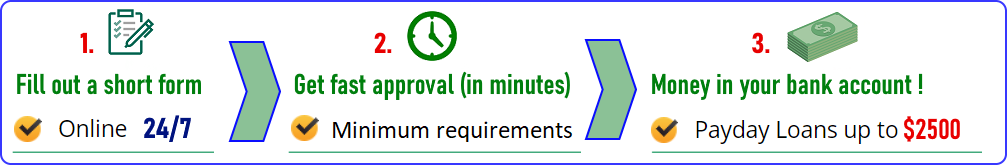

Financial solutions have evolved to match the fast-paced lives we lead in the age of the Internet. Online payday loans have emerged as a quick and convenient way to address immediate financial needs. Here’s a quick overview of how these loans work:

Application Process

Online Application: Borrowers initiate the process by filling out a simple online application form on the lender’s website. This form collects basic personal and financial information, like your name and employment history.

Online Application: Borrowers initiate the process by filling out a simple online application form on the lender’s website. This form collects basic personal and financial information, like your name and employment history.

Eligibility Check: Lenders quickly review the application to assess the borrower’s eligibility. This typically includes factors like age, employment status, income level, and citizenship.

Eligibility Check: Lenders quickly review the application to assess the borrower’s eligibility. This typically includes factors like age, employment status, income level, and citizenship.

Document Submission: Some lenders may require the borrower to upload supporting documents such as proof of income, identification, and bank account details.

Document Submission: Some lenders may require the borrower to upload supporting documents such as proof of income, identification, and bank account details.

Loan Approval

Rapid Assessment: Online payday loan lenders employ automated systems to swiftly evaluate applications. This process often takes minutes to hours, rather than days.

Rapid Assessment: Online payday loan lenders employ automated systems to swiftly evaluate applications. This process often takes minutes to hours, rather than days. Instant Decision: Based on the assessment, the borrower receives an instant decision on whether their loan application is approved.

Instant Decision: Based on the assessment, the borrower receives an instant decision on whether their loan application is approved.

Getting Paid and Repayment

Direct Deposit: Upon approval, the loan amount is directly deposited into the borrower’s provided bank account. This digital disbursement is one of the best features of online payday loans, ensuring you quick access to funds.

Direct Deposit: Upon approval, the loan amount is directly deposited into the borrower’s provided bank account. This digital disbursement is one of the best features of online payday loans, ensuring you quick access to funds. Due Date: The borrower agrees to repay the loan on the specified due date, which is usually aligned with their next payday. This timeframe can range from 7 to 30 days, depending on the loan terms.

Due Date: The borrower agrees to repay the loan on the specified due date, which is usually aligned with their next payday. This timeframe can range from 7 to 30 days, depending on the loan terms. Automatic Withdrawal: On the agreed-upon due date, the lender automatically withdraws the loan amount plus any fees from the borrower’s bank account. This eliminates the need for manual repayment and ensures that you can settle your loan quickly.

Automatic Withdrawal: On the agreed-upon due date, the lender automatically withdraws the loan amount plus any fees from the borrower’s bank account. This eliminates the need for manual repayment and ensures that you can settle your loan quickly.

How $100 – $1,000 Payday Loans Can Help You

Getting quick access to funds can make all the difference In times of financial crisis. 7-30 day payday loans ranging from $100 to $1,000 offer a lifeline for individuals facing unexpected expenses, providing them with the means to address urgent situations without unnecessary delays.

While these loans come with their own set of benefits and considerations, their accessibility, minimal eligibility requirements, and speedy approval process make them a valuable tool in managing unforeseen financial challenges.